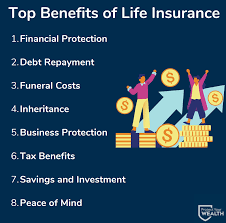

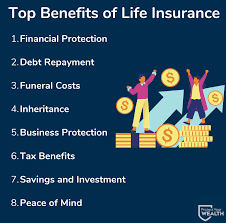

The Benefits of Life Insurance Beyond Financial Protection

Life insurance is usually mentioned in relation to financial security, however its benefits go far beyond the financial benefits. While most people recognize the significance of life insurance in protecting the financial security of their families .There are a few less-known benefits that could help in providing an enormous benefit in all areas of our lives. This article we’ll look at these advantages in depth and provide insight into the ways that life insurance can be used as a tool that can be used for the well-being of your family and yourself.

What Is Life Insurance?

Before we dive into the benefits, let’s first explain what life insurance is. Life insurance is an agreement between an individual and an insurance company in which the insurer pays an amount in lump sum to designated beneficiaries following the death of an insured. This money is used to pay for costs, debts, or add financial aid to family members.

1. Estate Planning and Wealth Transfer

The Benefits of Life insurance can be a valuable instrument for estate planning. It ensures that the death benefit is in place and available, life insurance may benefit pay for estate taxes and other costs that may require heirs to liquidate assets. This will ensure that the estate will be passed to the next generation alike to the wishes of the deceased without putting unnecessary financial stress for the beneficiaries.

For more in-depth details on estate planning using life insurance, read the Investopedia guide to Estate Planning.

2. Business Continuity

Business owners should consider life insurance, as it could play an important role in ensuring continuity of business. If there is a death of a major participant, the insurance could serve money to benefit to buy back the shares of the deceased, thereby stopping potential interruptions to business operations and also preserving its value.

Find out the basics of business continuity on Forbes’ Business Continuity Planning.

3. Support for Charitable Causes

Some life insurance policies allow policyholders to name an organization as beneficiary. It can be a worthwhile method of supporting charities and causes that matter to you, and leave the legacy that speaks to your beliefs and values.

Learn how you can leave a an impactful legacy to charity with the tips of Charity Navigator.

4. Building Cash Value

Certain kinds of life insurance policies, like whole life or universal life insurance policies, generate an amount of money over the course of time. The cash value can be used to borrow against or as collateral to secure loans. Additionally, it can be used to pay premiums or be withdrawn in the event of need. Life insurance can provide financial flexibility and could be an asset during times of need.

For a more in-depth understanding of the value of cash in life insurance, refer to our article on The Balance about Cash Value Insurance.

5. Access to Loans and Benefits

Life insurance policies usually favor access to a variety of additional benefits, including the possibility of accelerated death benefits. These benefits can be used in the event of a the onset of a terminal illness or for long-term care requirements, which allows policyholders to take advantage of a part of their death benefit when alive, helping financially during difficult times.

Find out more information about faster death benefits through Investopedia.

6. Coverage for Final Expenses

In addition to providing financial assistance life insurance also can help with final expenses like funeral expenses, medical bills as well as other expenses associated with the end of life. This means that the costs are not a burden for the family members and allows the family members to grieve without financial strain.

Check out Funeralwise’s guide to final costs for more details.

7. Psychological and Emotional Assurance

Life insurance can provide the peace of mind for policyholders as well as their families. Being aware that loved family members will be financially secure during their absence may ease anxiety as well as serve assurance. This assurance of emotional security is a major, yet often under-appreciated benefits of insurance for life.

Find out more on the psychology advantages of financial planning on Psychology Today.

Table: Types of Life Insurance and Their Benefits

| Type of Life Insurance | Main Benefit | Additional Benefits |

|---|---|---|

| Term Life Insurance | Financial protection that is cost-effective for a certain period | Easy to comprehend and simple to access |

| Whole Life Insurance | Lifetime coverage that includes an element of cash value | Builds cash value, stable premiums |

| Universal Life Insurance | Death benefits and flexible premiums | Adjustable coverage amounts, cash value component |

| Variable Life Insurance | Options for investment that offer potential for an boost in the value of cash | Premiums that are flexible and demise benefits |

FAQs

1. How can you tell the difference between term insurance and total life insurance?

Life insurance covers you for a certain period of time usually 10, 20 or 30 years. It provides a death benefit in the event that the insured passes away within that time. Life insurance that is whole, on contrary, provides coverage for the whole life of the insured and comes with a cash value component that will increase over time.

2. Can I utilize life insurance to fund my child’s schooling?

Certain life insurance policies generate cash value that you can borrow against. The cash value can be used to fund various goals for education, such as funding. It is important to know the rules and the potential implications for your policy prior to together the money.

3. How does life insurance fit into estate planning?

Life insurance is a great way to pay estate taxes and other expenses, which will ensure that your heirs get the entirety from your property. Also, you can leave an inheritance tax-free to your beneficiaries. This is especially beneficial for those with high net worth.

4. Are there tax benefits for life insurance?

Yes the death benefits of life insurance are typically paid in tax-free installments to beneficiary. In addition the growth of cash value in life insurance policies that are permanent is tax-free. However, loans or withdrawals on cash could be tax-related.

5. What is an accelerated death benefit?

The accelerated death benefit permits policyholders to take advantage of some of their death benefit in the event that they are diagnosed with an illness that is considered terminal. This could add the financial assistance needed to cover medical expenses and other requirements prior to the time that the policyholder dies.

Conclusion

Life insurance isn’t just a safety net to protect your loved ones once you’ve passed away. Its benefits include estate planning and charitable giving, business continuity and financial flexibility throughout your entire life. Knowing these benefits will benefit you make informed choices regarding your life insurance plan and assure that it’s in line with your personal and financial goals.

Author: Alex Johnson

To find more reading materials and information regarding life insurance and the benefits it offers, you can look into the following:

- Investopedia: Estate Planning

- Forbes: Business Continuity Planning

- Charity Navigator: Charitable Legacy

- The Balance: Cash Value Insurance

- Investopedia: Accelerated Death Benefit

Please feel free to contact us for any extra questions or to receive specific advice about the life insurance market and it’s numerous advantages.