Recent Losing Streak Ends Longest S&P Run Since 1928

It’s the only time (before this) when the S&P 500 had fallen five weeks in a row. This is the reasons why the market’s recent decline is difficult to accept.

It’s the only time (before this) when the S&P 500 had fallen five weeks in a row. This is the reasons why the market’s recent decline is difficult to accept.

The almost 11-year absence of these losses streaks was the longest period in the history of the index dating back to 1928 compatible to the analysts of Deutsche Bank, suggesting that the “relentless march” of US stocks in the past decade was not a chance described partly with “a buy the dip narrative.”

“The last decade has very much been the exception rather than the norm,” they wrote in a comment.

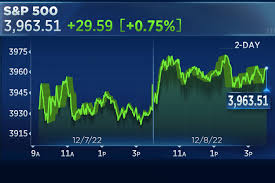

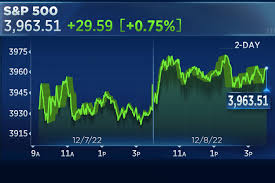

The benchmark stock index decreased 0.2 percent last week, but the five consecutive weeks of downs made it 9.3 percent lower than in the first week of April. There was no respite on Monday too. It fell 3.2 percent to end at 3,991.24 which was the lowest price since more than an entire year, and further into correction territory, down 17 percent from the record high it reached in January.

The recent slide in the S&P 500 illustrates how many variables have combined to lower price of stocks. Investors are increasingly concerned about the repercussions of rising inflation. Federal Reserve officials are raising the benchmark interest rate to combat price increases, but some believe they could create a recession if they are far too fast. Additionally the conflict in Ukraine and the COVID-19 lockdowns in China could create more disruptions to supply chains.

“Wall Street remains uninspired to ‘buy the dip’ as inflation seems poised to remain stubbornly high, which will force the Fed to tighten policy to levels that will jeopardize the soft landing most traders were expecting” for the economy, Edward Moya, a senior market analyst at OANDA stated in an opinion piece. “No one can confidently answer the question of when stocks will hit the bottom.”

Do you have a comment, question or story to submit? You can reach Diccon at 1c******593@d***e.com

Are you interested in reading more material similar to this? Join The Balance’s daily newsletter to receive analyses, insights and financial advice all delivered directly to your inbox each day!