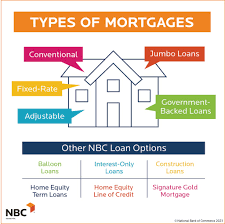

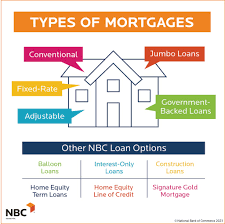

5 Types of Mortgage Loans

Like most people, mortgages will likely be necessary when purchasing a home. According to the US Census Bureau, 94% of homebuyers in 2021 used one as part of their purchase decision.

As soon as you start looking for a mortgage, it can be easy to feel overwhelmed. There are various types of loans out there – each designed specifically to meet different people’s needs – but how can you identify the one best suited for yourself? Below is our handy guide that explains all these choices so you can decide which option will be most suitable.

Key Takeaways

Fixed-rate conventional loans are the most widely held type of mortgage loan. For an adjustable-rate loan that suits your lifestyle better, opt for an adjustable rate mortgage instead. Your payment may change regularly as its rate fluctuates with market fluctuations.

Federal Housing Administration (FHA), Veterans Affairs (VA), and US Department of Agriculture (USDA) loans may be helpful if you lack a large down payment or have credit issues; however, other eligibility criteria must also be fulfilled to qualify.

Fixed-Rate Mortgages

Fix rate mortgages offer the security of an unchanging interest rate throughout the life of the loan, whether that means 15, 25 or 30 years. Your interest rate won’t fluctuate no matter what changes in the economy occur.

Each type of mortgage can be broken down further into distinct classifications. For instance, all mortgages either feature a fixed or adjustable rate option and it’s possible to choose either an FHA loan with fixed-rate payments or conventional adjustable-rate financing as your lender of choice.

Homebuyers Should Opt for This Type of Loan

A fixed-rate mortgage makes budgeting for payments easier because your monthly installment won’t change with changing interest rates or your payment amount will remain consistent throughout its term. On the downside, however, this loan comes with some restrictions and limitations that must be considered prior to applying for one.

Fixed-rate mortgage interest rates tend to be slightly higher than adjustable rate mortgage rates, making fixed rate loans an unfavorable choice during periods when interest rates are at their peak. Once purchased, these higher interest rates may remain until refinancing becomes an option.

Adjustable Rate Mortgages

An adjustable-rate mortgage (ARM) allows your payments to fluctuate more frequently than with fixed-rate loans. Each ARM loan agreement specifies how often and by how much the rate adjusts in any one step; there may also be lifetime limits set on how high it can reach.

Why Homebuyers Choose This Type of Loan

Interest rates tend to be lower for adjustable rate loans at the outset, thus making these more suitable loans for home buyers.

Some homebuyers utilize adjustable rate mortgages (ARMs) to keep payments lower at the beginning of their loans, which could prove useful if they plan to sell or refinance sooner rather than later, particularly before their first rate adjustment occurs. Unfortunately, however, ARMs can often be more complicated and confusing than fixed-rate loans.

Your loan payments may fluctuate significantly throughout its term, making it hard for you to afford your mortgage in the future.

Conventional Mortgages

Conventional mortgages refer to any loan provided by lenders who do not participate in government-backed programs, so if you don’t meet any special eligibility requirements, chances are this type of mortgage will likely be what’s right for you. Approximately 74% of all mortgages issued were conventional in 2021 according to US Census Bureau estimates.

Your lender typically sells conventional mortgages to Fannie Mae or Freddie Mac, who require that it meet certain guidelines to qualify as conforming loans. This makes these mortgages popularly known as conforming loans.

Why Homebuyers Seek These Types of Loans

Buyers may not qualify for other forms of mortgage loans with more favorable terms, like VA loans. Meanwhile, interest rates might be lower compared to some types of loans such as FHA.

But these loans have their limitations.

PMI will likely be necessary if your down payment falls below 20%, while it may be more challenging for individuals with lower credit scores or recent blemishes to obtain approval for government-backed programs.

VA Loans

VA loans can be an attractive choice for veterans and active-duty service members alike. Underwritten by the Department of Veterans Affairs, these mortgage loans often offer the best rates of all available mortgage types – without requiring a down payment (although you should always try to put as much down as you can afford). It may even be easier for you to secure approval than other types of mortgages due to lower credit scores or negative information in your file.

FHA Loans

Federal Housing Administration-backed FHA loans aim to make homeownership more attainable for people who would not otherwise qualify due to poor credit scores or insufficient savings for down payments. Though more costly than conventional loans, you could potentially qualify even with a credit score as low as 500 and 3.5% down.

USDA Loans

If you reside in a rural area and earn less than $40,000 per year, USDA loan program could be right for you. With no down payment necessary (though you should still put down as much as possible), no mortgage insurance fees apply and generally lower overall costs than FHA loans, USDA loans could be right for you.

Why Homebuyers Choose VA Loans

VA loans tend to be the cheapest mortgage options for current and former service members.

FHA and USDA loans provide access to home ownership for people who may otherwise not qualify for conventional mortgages due to credit issues or insufficient down payment savings. Both loans have certain limitations that must be observed prior to approval.

These loans may take longer to close as properties must be inspected and meet loan requirements before closing. USDA and FHA loans tend to be more costly than conventional loans for people with good credit who have saved up a larger down payment for these types of loans, while Jumbo Mortgages often cost even more.

Jumbo mortgage refers to any loan which exceeds the limits of traditional loan programs.

As an example, if a conventional mortgage exceeds what Fannie Mae or Freddie Mac will purchase, then it becomes a non-conforming jumbo mortgage – meaning it doesn’t conform with the limits established by those organizations. Also, veterans who use VA loans for home purchases that exceed their program limit would qualify as having taken out jumbo VA loans.

Why Homebuyers Choose This Type of Loan

Jumbo loans can be used to purchase expensive properties such as luxury homes. In regions with high costs of living, a jumbo loan may even be necessary when buying medium-value homes. But these loans have certain limitations which must be kept in mind before using one for your purchase.

These loans may require both excellent credit and income in order to be approved, so how can you tell which loan type is right for you? (Wikipedia:How Can You Determine Which Loan Is Appropriate?)

Your best option depends on a range of factors, including:

Credit Score and History, Down Payment, Income, and Ability to Take Advantage of Special Types of Mortgage Loans such as USDA or VA

Note

Before considering homeownership, make sure you find a reliable mortgage lender who will work with you to find the ideal type of loan and help make your homeownership dreams a reality.

Frequently Asked Questions (FAQs) (FAQs)

Which types of mobile homes qualify for financing?

Mortgages for mobile homes can be obtained from various lenders, each having specific criteria that must be fulfilled for you to qualify for one. For instance, FHA Title I loans stipulate that your mobile home must meet the Model Manufactured Home Installation Standards; their acceptable construction methods list runs to over 35 pages!

Which banks provide the best home loans?

Mortgages from large banks like Wells Fargo or Bank of America may offer suitable home loan solutions, but you might also find better home loan offers by approaching smaller local banks and credit unions directly. Mortgage brokers that represent multiple lenders may also help you find the most appropriate loan solution.

Are fixed-rate mortgages right for you?

Locking in low rates with a fixed-rate mortgage allows you to continue making affordable monthly payments even if interest rates rise in the future. If interest rates appear too high and may fall over time, an adjustable-rate mortgage (ARM) might be suitable; but if rates decrease with your fixed-rate loan you can usually refinance.